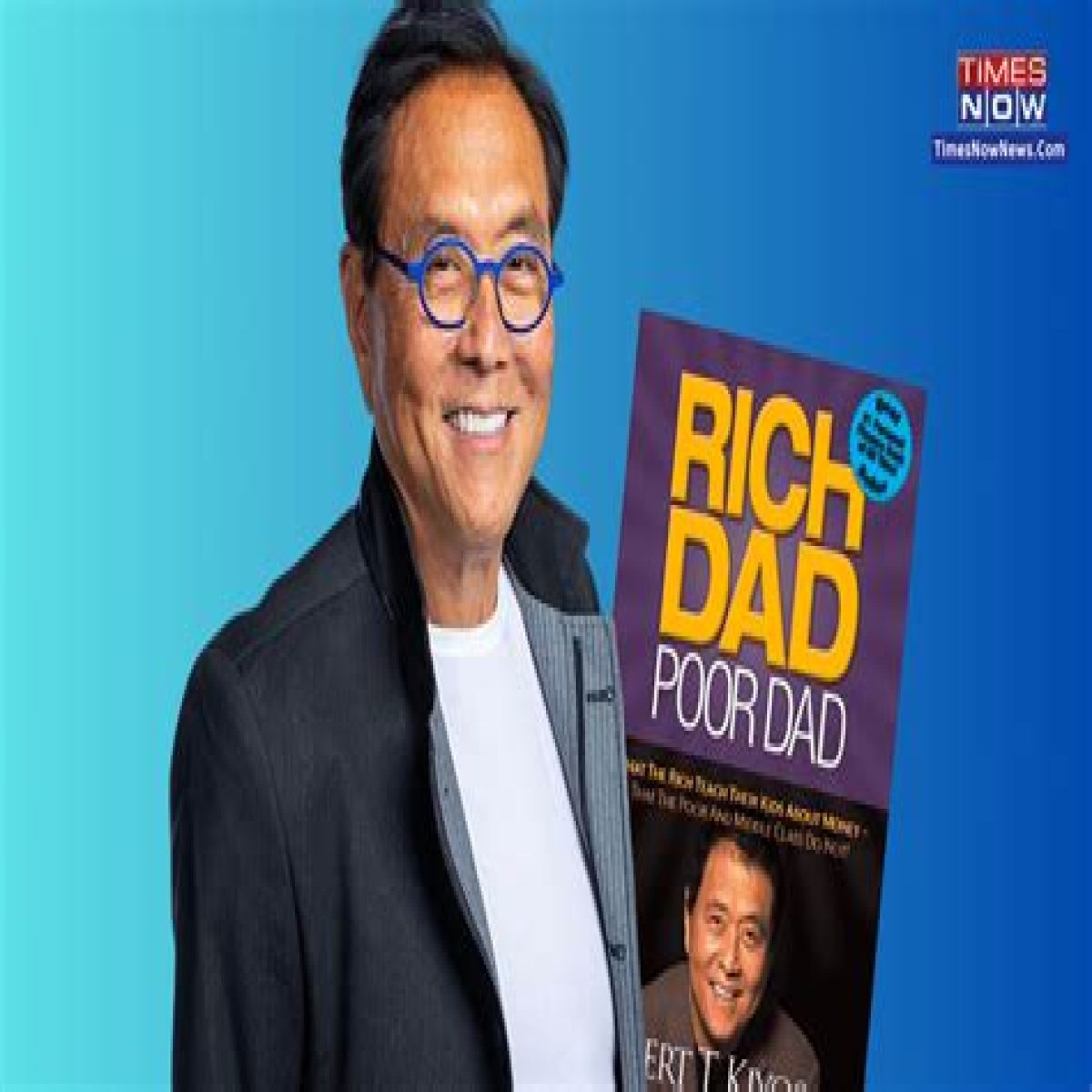

Ralph H. Kiyosaki is an esteemed entrepreneur, investor, and author best known for his revolutionary book "Rich Dad Poor Dad."

His unique perspective on financial literacy and wealth creation has transformed the lives of millions worldwide. Kiyosaki's teachings emphasize the importance of financial education, entrepreneurship, and developing multiple streams of income. He advocates for challenging traditional notions of employment and encourages individuals to take control of their financial futures.

In his books, seminars, and educational programs, Kiyosaki has consistently imparted valuable insights into the world of investing, real estate, and business. His emphasis on financial intelligence and the mindset of successful investors has resonated with countless individuals seeking financial freedom and abundance.

Ralph H. Kiyosaki

Ralph H. Kiyosaki, renowned entrepreneur, investor, and author, has revolutionized the world of personal finance and wealth creation. His teachings have left an indelible mark on individuals seeking financial freedom and abundance.

- Financial literacy

- Entrepreneurship

- Multiple streams of income

- Challenging traditional employment

- Financial intelligence

- "Rich Dad Poor Dad"

- Investing

- Real estate

- Business

These key aspects of Kiyosaki's teachings have transformed the lives of millions worldwide. His emphasis on financial literacy empowers individuals to take control of their financial futures, while his advocacy for entrepreneurship encourages them to pursue their passions and create wealth. The concept of multiple streams of income promotes financial stability and resilience. Kiyosaki's challenge to traditional employment norms has inspired countless individuals to break free from limiting beliefs and embrace new opportunities.

Financial literacy

Financial literacy is a cornerstone of Ralph H. Kiyosaki's teachings and a fundamental pillar of his philosophy on wealth creation. He emphasizes that financial literacy empowers individuals to take control of their financial lives, make informed decisions, and achieve financial freedom.

- Understanding financial statements

Financial literacy entails the ability to read and comprehend financial statements, such as balance sheets, income statements, and cash flow statements. This knowledge enables individuals to assess the financial health of companies, make sound investment decisions, and manage their personal finances effectively.

- Budgeting and debt management

Effective financial literacy involves creating and adhering to a budget that aligns with financial goals. It also includes understanding different types of debt, managing debt levels, and developing strategies to reduce debt and improve overall financial well-being.

- Investing and wealth creation

Financial literacy empowers individuals to make informed investment decisions and build wealth over time. It involves understanding different investment vehicles, such as stocks, bonds, and real estate, and developing an investment strategy that aligns with risk tolerance and financial goals.

- Retirement planning

Financial literacy is crucial for effective retirement planning. It enables individuals to assess their retirement needs, create a savings plan, and make informed decisions about retirement accounts, such as 401(k)s and IRAs, to ensure a secure financial future.

In summary, financial literacy is an essential component of Ralph H. Kiyosaki's teachings, providing individuals with the knowledge and skills to make informed financial decisions, manage their finances effectively, and achieve their financial goals.

Entrepreneurship

Entrepreneurship occupies a central position in Ralph H. Kiyosaki's teachings and philosophy on wealth creation. Kiyosaki emphasizes that entrepreneurship is a path to financial freedom and personal fulfillment, empowering individuals to take control of their financial destinies and create wealth through innovation and business ventures.

- Creating Value and Solving Problems

Entrepreneurship involves identifying unmet needs or problems and developing innovative solutions that create value for customers. Successful entrepreneurs are able to recognize opportunities, develop products or services that meet those needs, and effectively market and sell their offerings.

- Risk-Taking and Resilience

Entrepreneurship inherently involves taking calculated risks. Entrepreneurs must be willing to step outside of their comfort zones, embrace challenges, and persevere in the face of setbacks. Resilience is a key trait that enables entrepreneurs to navigate the ups and downs of business and ultimately achieve success.

- Building a Team and Culture

Effective entrepreneurs recognize the importance of building a strong and cohesive team. They create a positive and empowering work culture that attracts and retains talented individuals who are passionate about the company's mission and goals. Collaboration and open communication are essential for fostering a thriving entrepreneurial environment.

- Adaptability and Innovation

In today's rapidly changing business landscape, adaptability and innovation are crucial for entrepreneurial success. Entrepreneurs must be able to quickly adapt to market trends, technological advancements, and evolving customer needs. Continuous innovation is essential for staying ahead of the competition and maintaining a competitive edge.

These facets of entrepreneurship, as highlighted by Ralph H. Kiyosaki, provide a roadmap for individuals seeking to create wealth and achieve financial freedom. By embracing these principles and developing an entrepreneurial mindset, individuals can unlock their potential and build successful businesses that contribute to their financial well-being and overall success.

Multiple Streams of Income

Multiple streams of income is a core concept in Ralph H. Kiyosaki's teachings on financial literacy and wealth creation. Kiyosaki emphasizes that relying on a single source of income can be risky and limits one's earning potential. By diversifying income streams, individuals can increase their financial security, achieve greater financial freedom, and build long-term wealth.

One of the key benefits of multiple streams of income is that it reduces reliance on any one source. If one income stream experiences a disruption or decline, individuals with multiple streams have other sources to fall back on, providing financial stability and peace of mind.

Moreover, multiple streams of income allow individuals to maximize their earning potential. By exploring different income-generating activities, individuals can identify and capitalize on their skills, interests, and opportunities. This diversification can lead to increased overall income and accelerated wealth accumulation.

Real-life examples abound of individuals who have achieved financial success through multiple streams of income. Kiyosaki himself is a prime example, with income streams from book sales, real estate investments, and educational programs. Other notable examples include Warren Buffett, who has investments in stocks, bonds, and businesses, and Oprah Winfrey, who has income from her talk show, production company, and various endorsements.

Understanding the importance of multiple streams of income is crucial for achieving financial freedom and long-term wealth creation. By diversifying income sources, individuals can mitigate risk, increase earning potential, and build a more secure financial future.

Challenging traditional employment

Ralph H. Kiyosaki is renowned for challenging traditional employment as a path to financial freedom and wealth creation. He argues that the conventional model of working for a single employer in exchange for a fixed salary limits one's earning potential and perpetuates financial dependence.

According to Kiyosaki, embracing entrepreneurship and creating multiple streams of income are essential for achieving true financial freedom. He advocates for individuals to take control of their financial destinies by starting their own businesses, investing in real estate, and exploring other income-generating opportunities.

Challenging traditional employment requires a shift in mindset and a willingness to take calculated risks. It involves recognizing that one's earning potential is not solely determined by their job title or salary, but rather by their ability to create value and solve problems.

Numerous real-life examples demonstrate the success of individuals who have challenged traditional employment norms. Kiyosaki himself is a prime example, having built his wealth through real estate investing and financial education.

Understanding the importance of challenging traditional employment is crucial for achieving financial freedom and long-term wealth creation. By embracing entrepreneurship and diversifying income streams, individuals can unlock their full earning potential and take control of their financial futures.

Financial intelligence

Financial intelligence is a cornerstone of Ralph H. Kiyosaki's teachings and a key component of his philosophy on wealth creation. Kiyosaki emphasizes that financial intelligence is not simply about accumulating knowledge about finance, but rather about developing the mindset and skills necessary to make sound financial decisions and achieve financial success.

- Understanding Financial Statements

Financially intelligent individuals are able to read and understand financial statements, such as balance sheets, income statements, and cash flow statements. This knowledge enables them to assess the financial health of companies, make informed investment decisions, and effectively manage their personal finances.

- Investing and Wealth Creation

Financial intelligence involves understanding different investment vehicles, such as stocks, bonds, and real estate, and developing an investment strategy that aligns with risk tolerance and financial goals. Kiyosaki emphasizes the importance of investing for cash flow and building passive income streams to achieve financial freedom.

- Managing Risk

Financially intelligent individuals are aware of the risks involved in investing and take steps to manage those risks. They understand the importance of diversification, asset allocation, and hedging strategies to protect their wealth.

- Entrepreneurial Mindset

Kiyosaki believes that developing an entrepreneurial mindset is essential for financial success. This involves thinking creatively, taking calculated risks, and embracing innovation. Financially intelligent individuals are constantly seeking opportunities to create value and generate income.

In summary, financial intelligence encompasses a range of skills and knowledge that empower individuals to make informed financial decisions, manage risk, and achieve financial success. Ralph H. Kiyosaki's teachings provide a roadmap for developing financial intelligence and leveraging it to create wealth and financial freedom.

"Rich Dad Poor Dad"

Ralph H. Kiyosaki's groundbreaking book, "Rich Dad Poor Dad," has revolutionized the way millions of people think about money and wealth creation. Through compelling storytelling and practical advice, Kiyosaki challenges conventional wisdom and provides a roadmap for achieving financial freedom.

- Financial Literacy:

"Rich Dad Poor Dad" emphasizes the importance of financial literacy, empowering readers to understand financial statements, manage debt, and invest wisely. Kiyosaki argues that traditional education often fails to provide these essential skills, leaving individuals financially unprepared.

- Entrepreneurship and Business:

The book encourages readers to embrace entrepreneurship and business ownership as paths to financial independence. Kiyosaki highlights the value of creating multiple streams of income and building assets that generate passive income.

- The Power of Leverage:

"Rich Dad Poor Dad" introduces the concept of leverage, explaining how individuals can use other people's money, time, and resources to accelerate wealth creation. Kiyosaki emphasizes the importance of investing in assets that provide leverage, such as real estate.

- Mindset and Beliefs:

The book challenges limiting beliefs about money and wealth. Kiyosaki argues that our mindset and beliefs play a crucial role in shaping our financial outcomes. "Rich Dad Poor Dad" encourages readers to adopt a growth mindset and believe in their ability to achieve financial success.

These facets of "Rich Dad Poor Dad" provide valuable insights into Kiyosaki's philosophy on wealth creation. The book's teachings have empowered countless individuals to take control of their financial futures and achieve financial freedom.

Investing

Investing is an integral component of Ralph H. Kiyosaki's philosophy on wealth creation. He emphasizes the importance of investing for cash flow and building passive income streams to achieve financial freedom. Kiyosaki advocates for a long-term investment approach, focusing on acquiring assets that generate income and appreciate in value over time.

One of the key principles that Kiyosaki highlights is the difference between assets and liabilities. Assets are investments that put money in your pocket, while liabilities take money out of your pocket. Kiyosaki encourages investors to focus on acquiring assets, such as real estate, stocks, and bonds, that generate passive income and increase in value over time.

Kiyosaki also emphasizes the power of leverage in investing. He explains how investors can use other people's money, time, and resources to accelerate wealth creation. For example, investors can use leverage to purchase real estate or invest in businesses, amplifying their returns without having to use their own capital.

Real-life examples abound of individuals who have achieved financial success through investing. Kiyosaki himself is a prime example, having built his wealth through real estate investing and financial education. Other notable investors who have applied Kiyosaki's principles include Warren Buffett, Charlie Munger, and Robert Kiyosaki.

Understanding the connection between investing and Ralph H. Kiyosaki's teachings is crucial for achieving financial freedom and long-term wealth creation. By embracing Kiyosaki's investment principles and strategies, investors can build a strong financial foundation and secure their financial future.

Real estate

Real estate plays a pivotal role in Ralph H. Kiyosaki's philosophy on wealth creation and financial freedom. Kiyosaki views real estate as a powerful asset class that can generate passive income, appreciate in value over time, and provide tax benefits.

One of the key reasons Kiyosaki advocates for real estate investing is its potential for cash flow generation. Rental properties can provide a steady stream of passive income, which can supplement or even replace an individual's earned income. Additionally, real estate investments can appreciate in value over the long term, providing investors with capital gains when they sell the property.

Kiyosaki also emphasizes the tax benefits associated with real estate investing. Depreciation deductions, mortgage interest deductions, and other tax advantages can significantly reduce an investor's tax liability, increasing their overall return on investment.

Real-life examples abound of individuals who have achieved financial success through real estate investing. Kiyosaki himself is an avid real estate investor, and he attributes much of his wealth to his real estate holdings. Other notable real estate investors include Donald Trump, Warren Buffett, and Oprah Winfrey.Understanding the connection between real estate and Ralph H. Kiyosaki's teachings is crucial for aspiring investors seeking to build wealth and achieve financial freedom. By embracing Kiyosaki's principles and strategies for real estate investing, individuals can unlock the potential of this powerful asset class and secure their financial future.Business

The connection between business and Ralph H. Kiyosaki is deeply rooted in his philosophy on wealth creation and financial freedom. Kiyosaki views business ownership as a powerful vehicle for generating passive income, building wealth, and achieving financial independence.

One of the key reasons Kiyosaki advocates for business ownership is its potential for scalability. Unlike traditional employment, where earnings are often capped by an hourly wage or salary, businesses have the potential to generate income that scales with effort and investment. This scalability allows business owners to earn significantly more than employees and accumulate wealth at a faster pace.

Additionally, business ownership provides individuals with greater control over their financial future. As business owners, they have the autonomy to make decisions that directly impact their income and wealth. This control empowers them to create multiple streams of income, invest in growth opportunities, and build a legacy for themselves and their families.

Frequently Asked Questions about Ralph H. Kiyosaki

This section addresses some of the most common questions and misconceptions surrounding Ralph H. Kiyosaki's teachings and philosophy on wealth creation.

Question 1: Is Ralph H. Kiyosaki's advice only applicable to the wealthy?

No, Kiyosaki's principles are designed to be accessible to individuals of all financial backgrounds. His emphasis on financial literacy, entrepreneurship, and investing aims to empower people to take control of their financial futures, regardless of their current wealth.

Question 2: Do Kiyosaki's teachings promote get-rich-quick schemes?

No, Kiyosaki advocates for a long-term, sustainable approach to wealth creation. He emphasizes the importance of building a solid financial foundation, acquiring income-generating assets, and developing a strong mindset for financial success.

Question 3: Is it necessary to quit my job to follow Kiyosaki's principles?

Not necessarily. Kiyosaki encourages individuals to explore multiple streams of income and build passive income sources alongside their regular employment. This allows them to gradually transition to financial independence while minimizing risk.

Question 4: Can anyone become wealthy by following Kiyosaki's teachings?

While Kiyosaki's principles provide a roadmap for wealth creation, individual success depends on various factors, including effort, dedication, and market conditions. However, his teachings empower individuals to take control of their financial destiny and increase their chances of achieving financial freedom.

Question 5: Is it ethical to prioritize wealth creation over other aspects of life?

Kiyosaki emphasizes the importance of balance and personal fulfillment. He encourages individuals to pursue wealth creation as a means to achieve their goals and live a life of purpose and impact. However, he also stresses the value of relationships, health, and personal growth.

Question 6: What is the most important lesson to learn from Ralph H. Kiyosaki?

One of the key takeaways from Kiyosaki's teachings is the importance of financial literacy and taking responsibility for one's financial well-being. He encourages individuals to continuously educate themselves, challenge conventional wisdom, and develop the skills and mindset necessary to achieve financial success.

In summary, Ralph H. Kiyosaki's principles provide a valuable framework for individuals seeking to improve their financial literacy, build wealth, and achieve financial freedom. While his teachings do not guarantee instant riches, they empower individuals to take control of their financial destinies and increase their chances of achieving long-term financial success.

Transition to the next article section...

Tips by Ralph H. Kiyosaki

Ralph H. Kiyosaki, renowned entrepreneur and author, has imparted valuable insights on wealth creation and financial literacy through his teachings and best-selling book, "Rich Dad Poor Dad." Here are some key tips inspired by his philosophy:

Tip 1: Enhance Financial LiteracyAcquire a comprehensive understanding of financial statements, investing, and personal finance management. This knowledge empowers individuals to make informed financial decisions and navigate complex financial landscapes.

Tip 2: Embrace EntrepreneurshipExplore opportunities to start businesses and create multiple streams of income. Entrepreneurship fosters innovation, risk-taking, and the potential for substantial financial rewards.

Tip 3: Invest for Passive IncomeSeek investments that generate passive income, such as rental properties, dividends, and royalties. This strategy allows individuals to earn money even when not actively working.

Tip 4: Challenge Traditional EmploymentRethink the conventional path of relying solely on a single employer for income. Consider freelance work, part-time ventures, or business ownership to diversify income sources and increase financial security.

Tip 5: Develop a Growth MindsetCultivate a mindset that embraces continuous learning, risk-taking, and the pursuit of financial success. Believe in your abilities and stay committed to your financial goals.

Tip 6: Leverage Assets and DebtUtilize assets, such as real estate, stocks, and bonds, to generate income and build wealth. Understand the responsible use of debt to finance investments and accelerate wealth accumulation.

Tip 7: Seek Financial MentorshipConnect with experienced mentors who can provide guidance, support, and insights on wealth creation strategies. Learn from their successes and avoid common pitfalls.

Tip 8: Prioritize Financial Well-beingMake financial well-being a top priority. Allocate time and resources towards financial education, planning, and investing. Remember, financial freedom and security contribute to overall happiness and life satisfaction.

By embracing these tips inspired by Ralph H. Kiyosaki's teachings, individuals can enhance their financial literacy, explore new income opportunities, and lay a solid foundation for long-term wealth creation.

Conclusion

Ralph H. Kiyosaki's teachings have profoundly impacted the financial literacy and wealth creation journeys of countless individuals worldwide. His emphasis on financial education, entrepreneurship, and investing has challenged conventional wisdom and empowered people to take control of their financial futures.

Kiyosaki's principles provide a roadmap for building financial security, achieving financial freedom, and living a life of purpose and abundance. By embracing his teachings, individuals can develop the skills, mindset, and strategies necessary to navigate the complexities of the financial landscape and unlock their full financial potential.

Unveiling The Heart Of "Thomas Beaudoin Relationships": Discoveries And InsightsUncover The Secrets Of Marie Avgeropoulos' RelationshipsUnveiling The Enigmatic: Discover The Identity Of Gerry Dee's Better Half